In September, the A-share market in China remained weak, with the Shanghai and Shenzhen 300 Index falling by 2.01% for the entire month. In overseas markets, the US bond yields reached a new high not seen since 2007. On October 4th, the yield on 10-year US Treasury bonds closed at 4.73%, and the yield on 30-year Treasury bonds briefly exceeded 5%. The US stock market also experienced significant adjustments in September, with the Nasdaq and Dow Jones Industrial Average falling by 5.81% and 3.5% respectively.

During the phase of continuous interest rate hikes by the Fed, the US dollar and global funds flowing back to the United States, the pressure on various asset prices may gradually become apparent. There seems to be a sense of impending storm in overseas capital markets, and many domestic investors are concerned about whether it will have further impacts on the Chinese economy and capital market. In this edition of Deep Thoughts, we will discuss these related issues.

US Inflationary Pressure Stronger than expected

Although we are not experts in macroeconomic and global research, the impact of the monetary policies of the Federal Reserve on global capital markets is always significant and cannot be ignored. Therefore, we closely monitor the situation of inflation and interest rate trends in the United States. The current round of inflation in the United States and other developed countries has multiple factors contributing to it.

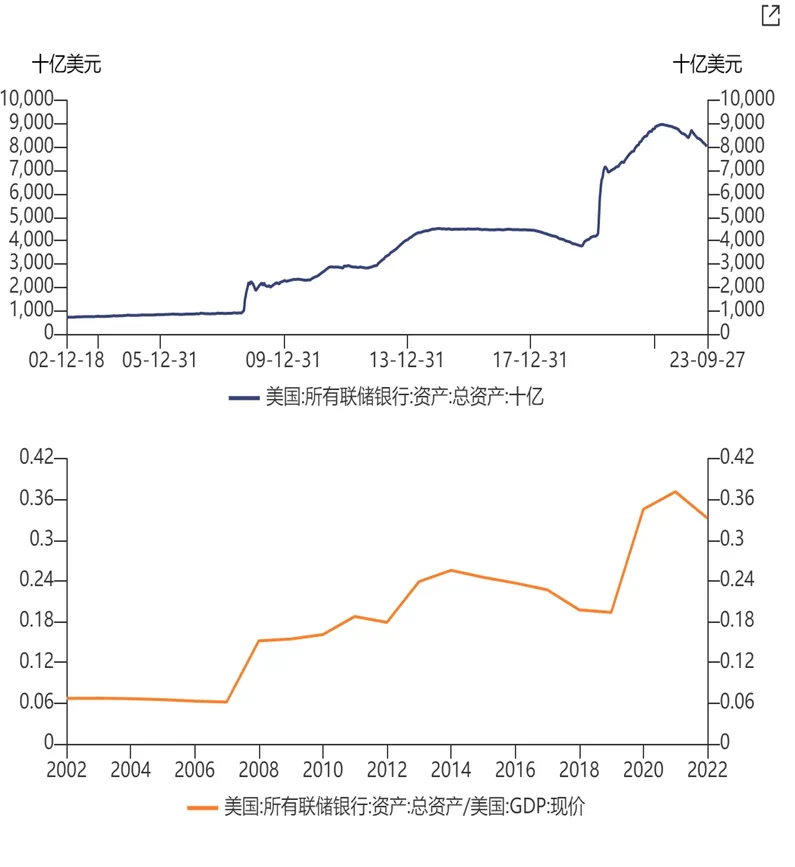

Firstly, from a long-term perspective, inflation is always a monetary phenomenon. Long-term low interest rates, continued quantitative easing by the Federal Reserve, and uncontrolled fiscal stimulus measures implemented after the occurrence of the COVID-19 pandemic and for the purpose of decoupling from China are the main internal factors driving inflation in the United States. After the bursting of the US subprime mortgage bubble in 2008, in an effort to rescue the US economy, Ben Bernanke conducted a grand experiment. Despite lowering interest rates to nearly zero, the effectiveness was insufficient, so the Federal Reserve initiated multiple rounds of quantitative easing and balance sheet expansion. The Federal Reserve's asset size increased from $894 billion at the end of 2007 to $4 trillion by 2013. During Janet Yellen's tenure as Fed Chair from 2014 to 2018, the Fed began a gradual process of balance sheet reduction. However, in 2020, in response to the impact of the COVID-19 pandemic, the Federal Reserve halted the balance sheet reduction process and embarked on a new round of expansion. By the end of 2021, the balance sheet had expanded to $8.95 trillion. The Federal Reserve's balance sheet expansion is equivalent to injecting a massive amount of high-powered money into the market.

Indeed, when facing significant downward pressure on the economy, the Federal Reserve has historically implemented a combination of interest rate cuts and balance sheet expansion to address the issues of economic downturn and insufficient employment. In the current situation of high inflation and an overheating economy, the appropriate prescription would be interest rate hikes and balance sheet reduction. This prescription has been used in history and is effective in addressing the specific problem. However, the challenge lies in the potential short-term pain for investors and the economy that may arise from the side effects when the medicine takes effect.

There are factors contributing to the intensification of inflation beyond monetary excess. These factors include attempts to decouple from China by imposing high tariffs on Chinese goods, which in turn leads to increased demand for alternative production capacities outside of China. The upstream resource industries have experienced a long-standing lack of capital expenditure, resulting in limited supply elasticity. The establishment of new production capacities outside of China adds additional demand for upstream resources, leading to higher resource prices and exacerbating inflation.

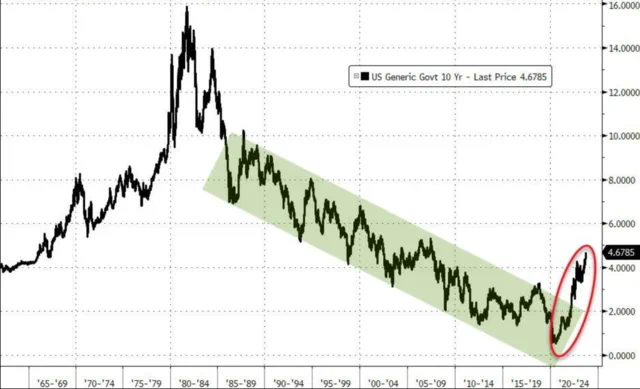

The chart above may be familiar to many: since reaching its peak in 1982, US interest rates have shown a downward trend over the past 40 years. Interestingly, this 40-year period coincided with China's reform and opening-up, its integration into the global supply chain, and its provision of high-quality and affordable goods to the world, which helped developed countries keep inflation low. However, since President Trump took office in 2018 and implemented significant tariff hikes on Chinese goods as part of the "decoupling" strategy, it objectively increased costs for American consumers. Controlling inflation and decoupling from China are currently two incompatible objectives. At present, the former undoubtedly takes precedence in US policymaking and may present an opportunity to ease trade tensions between the two countries. Recently, there have been strikes by US auto-making unions demanding significant wage increases to cope with inflation. If successful, these wage increases could lead to a spiral of rising prices and wages.

Looking at the long-term interest rate range in the US, the phenomenon of extremely low rates has only been observed in recent years since 2008. Considering low rates as a given is probably not appropriate. The total size of US government debt has exceeded $32 trillion, and if inflation is not reduced soon, persistently high interest rates will become an unbearable burden for US finances. Therefore, making every effort to bring down inflation is undoubtedly the optimal option.

In upstream resources sector, since 2015, the prices of crude oil and coal have experienced a prolonged period of low prosperity, coupled with society's expectations for carbon neutrality. As a result, capital expenditure in the resource industry has remained low, while demand has continued to grow steadily. In the past two years, although energy companies have seen significant improvements in profitability, most of them have chosen to reward shareholders through high dividends and stock buybacks rather than increasing capital expenditure and capacity supply, which is not conducive to easing inflation. Additionally, communication and cooperation between OPEC and Russia have become smoother and closer, making consensus on production cuts and price support easier to achieve than before, thus enhancing the resilience of energy prices. Furthermore, the outbreak of the Russia-Ukraine conflict has had some impact on the supply side as part of the sanctions against Russia. At the same time, providing economic and military assistance to Ukraine has also exerted some inflationary pressure.

On the other hand, in order to support the reshoring of high-end manufacturing to the United States, the US has implemented substantial subsidy policies for the semiconductor and new energy industries, which have also fueled economic growth and inflation.

The Chinese and US economies are phased in exact opposites

The economic cycles and positions in the capital markets of China and the United States are completely opposite. Currently, the biggest problem facing the United States is excessive aggregate demand, with the economy and inflation running too hot, requiring interest rate hikes and balance sheet reduction as a response. In the process of cooling down the economy and aggregate demand, cooling down the capital markets becomes an intermediate goal. If the capital markets remain strong and there is a significant wealth effect, it is unfavorable for cooling down aggregate demand. China, on the other hand, is facing insufficient aggregate demand, so the prescription should be interest rate cuts and expansionary monetary policy, supplemented by an active fiscal policy, in order to boost aggregate demand in a timely manner. Of course, boosting confidence in the capital markets and the wealth effect will also be an unavoidable intermediate goal.

Recent investment strategy:

It is believed that the A-share market has entered a bottom range, which is already a consensus among many investors. However, when and how the market will start an uptrend is a question that most people are struggling with. Of course, some investors hope for more precision and prefer to enter the market after the market has confirmed the initial upward trend. These mindsets are understandable because different investment styles and different amounts of capital will lead to significant differences in operating strategies. However, we need to examine whether the methods and strategies we plan to adopt now have a successful and satisfactory track record in history. If we have had a good long-term result with a certain method, it is wise to stick to that effective method. If the method has consistently produced poor results, we need to calmly review the situation and identify where the problem lies. Let us not forget the wise words of an investment expert who said, "We cannot use the methods that have caused losses in the past to make up for those losses."

There are no major adjustments to the investment strategy compared to the previous period. Patience is advised in the bottom range to position oneself in excellent companies. Give policy measures some time, give "crops" sufficient time to grow, avoid impatience and allow for spring blossoms to come naturally.

Best Regards,

Wu Weizhi

Oct 2023

本期《偉志思考》簡體中文版鏈接:

伟志思考:树欲静而风不止

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09