WE THINK: Reviewing how A-shares recoverd from the previous bear markets. What’s the commonality of successful investment decisions?

In August, the A-share market continued its previous weak trend, and the market still lacked a profit-making effect. Although driven by mysterious incremental funds, the stock prices of major banks in various countries reached new highs, most other companies' stock prices continued to decline. The Wind All China Index fell by -3.97% for the entire month, and the CSI 300 dropped by -3.51%. Without the support of major banks and the two state-owned oil companies, the index's performance would have been even worse. As of August 30, the number of stocks that rose this year was only 595, accounting for 11.12% of the total 5,349 A-shares in the market. The median stock in the market saw a decline of -26.13%. (As of June 30, 2024: among the 5,379 listed companies in the market (including 16 that were delisted this year), only 800 companies (including those listed this year) rose in the first half of the year, accounting for 14.87%. The median stock in the market had a decline of -23.53%.) It can be seen that by the end of August, the loss effect had further intensified compared to June 31. One can truly feel the helplessness and despair of most investors. Indeed, as someone who has been through it, I can empathize with the pain and despair felt by friends experiencing the significant wealth losses of a bear market for the first time!

Once again, we have returned to the familiar environment of a bear market, where the net value of many funds issued at market highs has been halved or more, and three-mao funds are not uncommon. Many previously popular stocks have seen their prices drop by 70%, 80%, or even more. Numerous industry data and corporate reports are showing deterioration, with a significant gap between macro data and micro experiences. Market trading volume has further shrunk, and the number of investors resolutely cutting losses and leaving the market is increasing. Conversations at social gatherings now often revolve around cherishing life, lying flat, and staying away from stocks. Formerly revered star fund managers have stepped down from their pedestals, and negative media coverage is on the rise. In contrast to the peak period where stock market gurus were everywhere, investors now meet to compare their miseries.

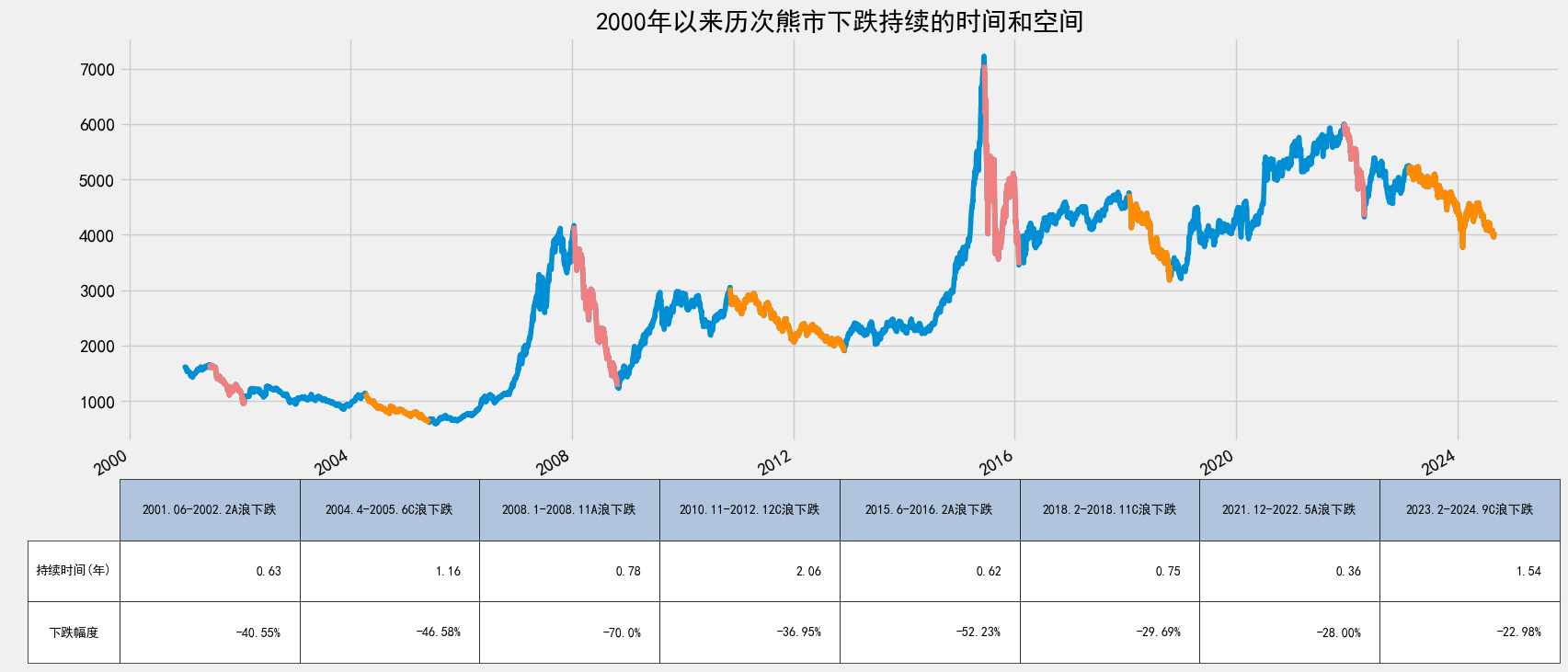

No bear market bottoms without despair! In this issue, we will review the recent three rounds of major bear markets' C waves since 2000 and examine the situations at that time. We will also discuss how the markets eventually emerged from these bear markets and welcomed the next upward cycle. In the previous issue, we explored the common traits of some of the most disastrous investment decisions; this time, we will briefly discuss the commonalities of some of the most successful investment decisions.

Generally, a complete bear market goes through two stages of decline. The first stage begins when the market peaks and starts to turn downward. At this point, the macroeconomic environment and corporate profitability have usually not yet worsened. This phase of decline is often referred to as the "A wave" of the bear market, characterized by a valuation correction. Typically, the A wave experiences a rapid decline that does not last long, but the magnitude of the drop can be significant, often ranging between 30% to 50%. Of course, the extent of the decline largely depends on the level of bubble in the preceding bull market; if the bubble is severe, the A wave's impact can be quite substantial. However, unless investors have leveraged their positions, the A wave is usually not fatal, as it does not last long before a significant rebound wave follows.

In this industry, the significant rebound that occurs after the bear market's A wave is generally referred to as the B wave rebound. The B wave rebound can be substantial in magnitude and prolonged in duration, with some strong sectors and individual stocks even reaching new highs during this phase. As a result, the B wave rebound can create the illusion that the bull market has not ended or is about to return.

After the B wave ends, the market enters the second round of declines in the bear market, which is commonly referred to as the C wave decline. When considering the time spent in the bottom oscillation period after the C wave ends, the most notable characteristic of the C wave is that it may last for a relatively long time. During the C wave phase, macroeconomic data and corporate financial reports often deteriorate. Moreover, in many industries and companies—especially cyclical ones—despite significant drops in stock prices, the decline in performance can be even more dramatic. This can result in a situation where, from a traditional price-to-earnings (PE) valuation perspective, stocks become increasingly expensive as their prices fall.

What truly drives investors to despair is often during the C wave. During this phase, the long-term loss effect and the market's reflexivity lead to a continued net outflow of funds. With already thin trading volumes and a lack of liquidity, any outflow exacerbates selling pressure, resulting in greater downward pressure on stock prices. The decline in stock prices can trigger further stop-loss selling. In this stage, the short-term drop in prices may have little to do with the fundamentals and is entirely driven by the market's reflexive nature. This reflexive force in the market seems unsolvable in the short term, contributing to the suffocating despair many feel. I also experienced a similar sense of suffocating despair during my first encounter with the C wave of a bear market. However, after personally navigating the market and witnessing how it inevitably exits a bear market to enter a new cyclical phase, I no longer feel even a hint of fear regarding this suffocating despair caused by short-term reflexivity. On the contrary, I have even become fascinated by this sense of "suffocation and despair." Because I know that it is precisely this "suffocation and despair" that creates the necessary conditions for us to make the most successful investment decisions!

The C wave of the first round of the bear market occurred from April 2004 to June 2005, and for many investors, this may feel like a very distant history. At that time, in addition to the decline in stock prices and the lack of profit-making opportunities, what left everyone feeling desperate and bewildered was the issue of resolving the listing and circulation of corporate shares. Prior to this, only about 30% of the total share capital could be traded. The thought of corporate shares—amounting to twice the existing tradable shares—being released for public trading was daunting. How could the limited funds in the market possibly absorb this massive influx? At that time, I had already spent 11 years in the industry, and facing the prospect of releasing these corporate shares felt like the sky was about to fall! A bull market seemed very unlikely to return.

In fact, while the debate over whether corporate shares could be listed continued, starting from 2003, excellent companies like Moutai, Suning, and Yanhua Potash had already begun to stabilize and stop their declines. Although the market was still shrouded in the suffocating and desperate atmosphere of the C wave bear market, these companies with the best fundamentals and high earnings certainty began to rise gradually in 2004 and 2005, resulting in some individual stocks generating profits.

Later, after June 2005, with the first batch of pilot companies for the split share structure reform being implemented, the stock prices of these pilot companies opened low and closed high, creating a significant profit-making effect. Three consecutive large bullish candles began to change people's beliefs. The market shifted from fear of the share structure reform to actively seeking opportunities, as any suspension for share structure reform would lead to a surge in stock prices. The market transformed from a negative feedback loop of losses to a positive feedback loop of gains.

This profit-making effect further attracted outside funds into the market, and in 2006 and 2007, the Wind All A Index rose by 111.9% and 166.2%, respectively. Many friends also realized a significant leap in wealth during this transition from bear to bull market.

The C wave of the second round of the bear market occurred from November 2010 to December 2012. After experiencing the impact of the 2008 U.S. subprime mortgage crisis and the financial tsunami, the A-share market turned downward from the bull market peak of 6,124 points on the Shanghai Composite Index in October 2007, dropping directly to 1,664 points in October 2008. Subsequently, stimulated by a massive infrastructure investment of 4 trillion yuan, the A-share market began a significant B wave rebound, rising to around 3,400 points.

Starting in 2010, macroeconomic policies shifted from marginal easing to tightening, and industries related to investment and infrastructure faced severe overcapacity and declining economic conditions. The market's loss effect and shrinking trading volume became increasingly serious. At that time, we at China Europe International Business School had already been established, but we were still in the team-building and adjustment phase. Coupled with the negative feedback from market losses, making profits became very difficult, leading many colleagues to question how much longer we could sustain our efforts and whether the company could continue operating.

By 2012, its been 19 years since I joined in the industry. Although I had yet to achieve any outstanding results, I gained considerable confidence in understanding and grasping the cyclical patterns of the stock market. I firmly believed that although there was still no visible force to break the negative feedback at that time, I was confident that as good companies became increasingly undervalued, the supply-demand relationship would inevitably reverse.

Based on the patterns observed at the end of previous bear markets and the initial phases of bull markets, we believe that the companies capable of leading the market recovery at the end of a bear market will be those with the strongest fundamentals and the highest certainty of earnings growth—namely, high-quality growth stocks. Therefore, from 2011 to 2012, our investment research team focused on growth-oriented companies to prepare our research in advance. I remember that we studied companies related to mobile internet, such as Wangsu Science and Technology.

Indeed, entering 2013 and 2014, while the overall market remained in a bottoming phase, a number of high-growth companies began to rise ahead of the market. In 2013, although the main index did not increase, our fund's net value grew by over 30%. Benefiting from our focus on researching quality growth stocks during the C wave of the 2011-2012 bear market and our patient winter planting strategy, we achieved strong performance for three consecutive years from 2013 to 2015. In early 2016, we won the "Morningstar China Annual Best Private Equity Fund Award" for the first time, as well as the Golden Bull Award from China Securities Journal. That year, we began to attract the attention of more investors and gradually established a reputation for China Europe International Business School as a leader in growth stock investment.

The C wave of the third round of the bear market occurred from January 2018 to December 2018. Due to domestic de-leveraging and the escalating trade tensions between China and the United States, the B wave rebound that had started in early 2016 came to a sudden halt. This C wave decline was relatively rapid, and the negative feedback from losses was severe. At that time, major shareholders of listed companies with high pledge ratios faced the risk of stock prices falling below their stop-loss lines, leading to forced liquidations, creating a very difficult and perplexing situation.

The short-term reflexivity of the market seemed unsolvable, while various grand narratives provided convincing but ultimately misleading explanations. The degree of "suffocation and despair" was very severe. I remember around October 18, 2018, I was attending a completion module at a business school for a few days when market panic was at its peak. Upon returning, our company's investment committee and risk control committee held a joint meeting for the first time in the 11 years since the company's establishment. At that meeting, I represented the research team and expressed the view that the market had entered a phase where many excellent companies were undervalued, but it was also experiencing panic selling, and short-term reflexivity might continue to drive prices down.

From a short-term perspective, it was likely that the market would struggle to rise, but from a slightly longer time horizon, the characteristics of the later stages of a bear market were becoming increasingly apparent. It was time to engage in "short-term painful but long-term correct actions." We suggested that for products without pressure from risk control or liquidation, the current position should not be less than 50%. While we were hesitant to go fully invested against the trend in the short term, we needed to maintain a 50% position because during the panic phase, selling quality companies' shares would lead us to buy them back at higher prices when market sentiment stabilized—an action that contradicted the essence of investing.

After thorough communication, the team reached a consensus: we would maintain a 50% position and closely monitor for signals to increase our holdings. Three months later, shortly after New Year’s Day 2019, when we saw clear signals of a market turning point, we were well-prepared with our strategies and targets. Within two trading days, we successfully acquired the positions we aimed to increase.It was precisely during the most "suffocating and despairing" moments of the C wave in the second half of 2018 that we did not succumb to despair. On the contrary, our hearts were filled with anticipation as we diligently conducted various research and preparation work. This allowed us to quickly increase our positions at the beginning of 2019. It was these actions that enabled us to achieve substantial investment returns in the following three years of 2019, 2020, and 2021.

After personally experiencing multiple cycles of bull and bear markets, we are acutely aware of the challenges of investing and the counterintuitive nature of it! The investment decisions that yield the best returns are often not made during prosperous economic conditions when both ourselves and investors are filled with confidence. On the contrary, many decisions made when we feel confident about economic trends and the stock market often yield unsatisfactory results in hindsight.

During the later stages of each bear market's C wave, we frequently observe many excellent companies becoming very undervalued. While not all companies are priced attractively, it is possible to find a number of "companies worth buying" in the market. Furthermore, in such environments, it is difficult to identify factors that can break the negative feedback loop of the market's reflexivity, but that’s okay! Every time we emerge from the C wave of a bear market, it typically starts with a few standout stocks, followed by more and more. Once there are enough strong stocks, the market transitions from a bear market to a bull market. Reflecting on my own experiences and those of my friends, most of our most successful investment projects were made during the C wave of a bear market, where we positioned ourselves in "companies worth buying" that had already fallen significantly. Later, the simultaneous occurrence of earnings growth and valuation increases during a bull market led to what is known as the "Davis double play."Below, we summarize some common characteristics of these types of investment projects.

Whether it is Moutai and Suning in 2004, Wangsu Technology in 2012, or SkShu and Proya in 2018, these high-flying stocks that we have witnessed firsthand, with returns of 10 to 30 times, share some common characteristics. After reflection, I have identified three key points:

1. Strong Fundamentals in Their Industry: These companies had the strongest fundamentals in their respective industries, characterized by sound business models and significant pricing power. A company's competitiveness must be the strongest within its industry; only companies with excellent fundamentals can become friends of time. Companies without a significant economic moat or sufficient pricing power are not necessarily unworthy of investment, but they can only be suitable for trading-oriented investments during certain phases. Long-term holding of such companies will still face challenges, as they may struggle to maintain consistent growth and profitability over time.

2. Attractive Valuations: The stocks were significantly undervalued at the time of investment, providing ample room for price appreciation. Good companies can also incur significant losses if purchased at an inflated price. For example, buying core Chinese assets in 2021 or investing in America's "Nifty Fifty" in 1973 involved many strong companies, yet they were in a phase of valuation bubbles. Investing in these good companies not only failed to generate profits but also subjected investors to prolonged periods of hardship.

So, when is the best time to buy high-quality companies? If individual investors do not have a deep understanding of company performance assessment and valuation, the "suffocation and despair" phase is undoubtedly the best time to invest. During this stage, no one wants to hold stocks, and everyone is selling, which often leads to a more thorough and complete compression of valuation bubbles. Reflecting on my career, I find that some of my most successful investment decisions were made during these "suffocation and despair" phases!

3. Deep Connection to Their Era: Great growth stocks often carry the deep imprint of their times. They align with broader economic trends or societal shifts, capitalizing on emerging opportunities that resonate with the needs and preferences of consumers during that period. High technology is always influenced by the historical context and imprint of its time. Once, innovations like canals, railroads, radio, home appliances, automobiles, personal computers, and smartphones were the shining stars of their respective eras in both history and capital markets. In the A-share market, the stars of the bull market in 1996 were Shenzhen Development Bank and Sichuan Changhong; in 2006, it was Moutai and Suning; and in 2019, it was consumer goods and renewable energy. Today, who still cares about Shenzhen Development Bank and Sichuan Changhong?

These commonalities highlight the importance of identifying strong, undervalued companies that are well-positioned to benefit from the evolving economic landscape, leading to substantial investment returns.

Who will be the shining stars in the next bull market? One thing is certain: the star stocks from the previous two bull markets will likely not be the same. This is why we always have endless research topics and ongoing studies. Investing is the realization of knowledge. In the past few bull markets, we have generally kept up with the main themes, thanks to the breadth and depth of our team's research. As long as we maintain an open mind and curiosity, and continue to learn without interruption, we will naturally grasp the main themes.

Recent Investment Strategy

Is the market currently in a phase of "suffocation and despair"? I believe it is difficult to have a unified answer to this question.

Our team has navigated through many rounds of bear market C waves, and our understanding of the patterns this time is more mature than ever before. The scale and quality of our team have reached new heights that China Europe International Business School has not previously achieved, and our preparations are progressing in an orderly manner.

The "suffocation and despair" phase is often a necessary condition for making the most successful investment decisions! Perhaps it’s not yet time to go all in, but we are increasingly less pessimistic, as there are more and more companies in the market that meet the "buyout company standards."

Wu Weizhi

Sep 1st 2024

本期《偉志思考》簡體中文版鏈接:

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09