WE Think:Mid-Year Reflections 2025: A Turbulent World, a Stable China

The past six months have been exceptionally volatile globally, marked by major events:

· DeepSeek disrupted U.S. dominance in AI.

· China saw a surge in innovative drug business development (BD).

· Trump’s "Tariff 2.0" and the temporary halt/restart of U.S.-China trade talks.

· The Russia-Ukraine war entering a protracted phase.

· Military clashes between India and Pakistan.

· The 12-day Israel-Iran conflict and the ongoing Israel-Hamas war.

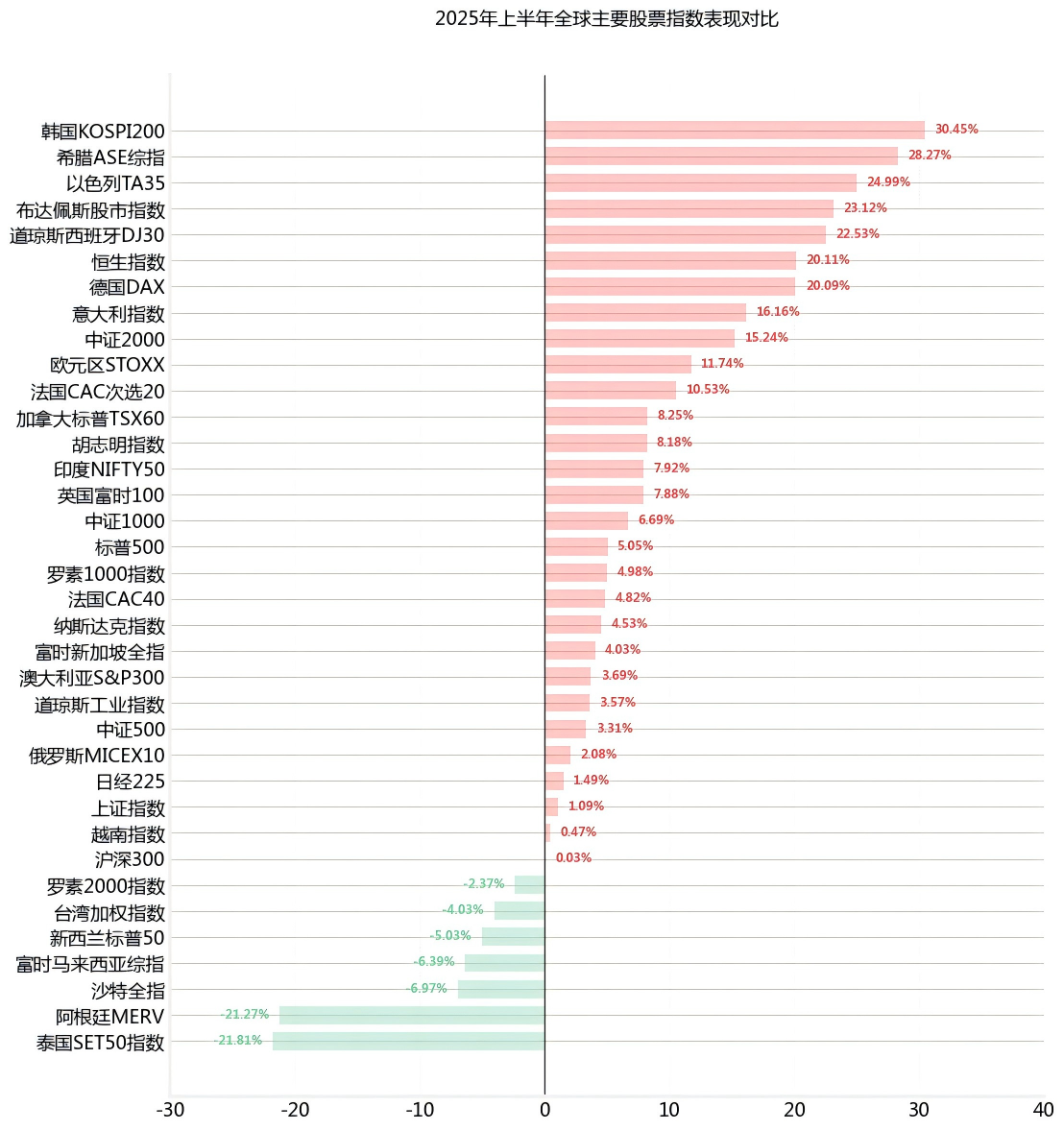

Never before have so many wars erupted simultaneously in such a short span. The world grows ever more precarious. While geopolitical tensions escalate, global stock markets have performed relatively well. Major U.S. indices and China’s key benchmarks posted positive returns, with Hong Kong’s market standing out—its rally ranked among the strongest globally. The Hong Kong Stock Exchange (HKEX) raised HK$106.73 billion in IPO financing in the first half, topping the world.

In line with our early-year assessment, China’s equity markets ended their bearish phase in H1 2025, entering a consolidating upward trend. Structurally, Hong Kong stocks (HKEX) and tech sectors led the rally, while A-shares traded in a range-bound pattern. By June 30, key indices posted the following gains:

Ÿ CSI 300: +0.03%

Ÿ Wind All-A Shares Index: +5.83%

Ÿ Hang Seng Index (HSI): +20.11%

Small-cap A-shares outperformed large-caps. Meanwhile, all funds managed by Rabbit Fund significantly outperformed their benchmarks, underscoring our active investment strategy.

Image: 2025 H1 Global Major Stock Indices Performance

Among the myriad events, three stand out for their profound implications:

1. The U.S.-China trade decoupling and restart.

2. The India-Pakistan conflict.

3. The Israel-Iran war.

In this issue of WE Think, I discuss my thoughts on these events, as well as the recent developments in China's economy and stock market.

Lessons from the U.S.-China Trade Pivot

On April 2, the U.S. imposed reciprocal tariffs, prompting China to respond in kind. After multiple rounds of escalation, bilateral tariffs exceeded 100%, halting trade flows. Eventually, the U.S. relented, and the May 12 Geneva Agreement saw both sides rescind recent tariff hikes, reopening trade.

Key Takeaways:

1. Decoupling is painful for both, but the U.S. is less resilient. This episode proved China’s readiness for even full decoupling, rendering such threats ineffective against major powers like China.

2. Strategic equilibrium achieved. China’s tightened rare-earth export controls exposed a vulnerability, while the U.S. relaxed EDA software restrictions. This marks a shift from strategic defense to a stalemate phase.

Vietnam recently signed a U.S. trade deal: the U.S. imposes a 20% tariff on Vietnam, while Vietnam grants zero-tariff market access to U.S. goods (rumors suggest that the Trump family has recently landed major projects in Vietnam). This deal may set a template for other ASEAN nations, leaving them little room for better terms. The emerging global trade model appears to be: the U.S. charges 10%-X% tariffs on partners, while exempting them from U.S. tariffs (China charges the United States 10%, while the EU is still negotiating). Except for China and the EU, other nations lack leverage to resist and must accept these terms. The U.S. leverages its market size to dictate favorable terms, securing "VIP" status in global trade.

Insights from the India-Pakistan and Israel-Iran Conflicts

May 7: India-Pakistan Aerial Skirmish

A rare beyond-visual-range (BVR) dogfight between comparable military tech (J-10C vs. Rafale) ended with Pakistan’s superior long-range engagement capabilities. This shocked observers, signaling China’s military-industrial parity—or even leadership—in certain domains.

June 13: Israel-Iran Escalation

Israel’s "Operation Rising Lion" (200+ airstrikes on 100+ Iranian targets) triggered Iran’s drone/missile counterattacks. Despite heavy interceptions, Iranian strikes disrupted Israeli life, exposing its lack of strategic depth. Public discontent mounted, forcing Israel to seek U.S. intervention (B-2 bombings). A ceasefire followed on June 24.

The U.S. claims its airstrikes crippled Iran's nuclear program, while Iran initially denied damage before later admitting significant losses. Now, Iran has abruptly halted IAEA inspections, a highly unusual move that raises new concerns.

Can Iran's Nuclear Facilities Be Destroyed?

Iran's Fordow facility is deeply buried under 80-90m of granite in the Alborz Mountains (2,400m altitude). Given Israel's past failure to fully destroy Iraq's nuclear sites, Iran's defenses appear robust.

Israel's vulnerabilities: Even advanced air defenses can't intercept all missiles in a saturation attack.

Iran may not be able to defeat Israel militarily, but it is better than Israel in other aspects, and its ability to withstand attacks should be stronger than Israel's.

China's Economic Outlook & Policy Prospects for H2 2025

China's GDP growth appears solid, but persistent deflationary risks remain. CPI has hovered near zero for eight consecutive quarters (Q2 2023-Q1 2025), with seven straight months of negative growth (Nov 2024-May 2025).

After September 2024's policy stimulus boosted markets and real estate briefly, fiscal support has eased. With H1 2025 data confirming weak demand, policymakers are expected to renew focus on countering deflation.

Key policy moves on July 1 signal intensification:

Anti-"involution" measures: The Central Financial and Economic Affairs Commission reiterated crackdowns on excessive internal competition

Fertility incentives: New subsidies aim to reverse declining birth rates—a critical long-term growth driver.

Given these developments, we expect significant policy intensification in H2 2025, particularly in:

Ÿ Demand-stimulating measures

Ÿ Anti-"involution" reforms

Ÿ Structural adjustments to sustain economic vitality

The leadership's dual focus on immediate stimulus and demographic preservation suggests a comprehensive approach to stabilizing growth while addressing systemic challenges.

Capital Market Perspective

The current phase—where the economy is stabilizing and policy support is intensifying—typically creates a low-risk environment that is favorable for equity investment. However, most first-level thinkers—investors who rely solely on surface-level data—remain cautious during this period. They are still waiting for clearer signs of economic recovery due to persistently weak economic indicators.

What many investors miss is that markets often bottom when sentiment is darkest. Policy shifts (like September 2024's measures) typically precede economic recovery by months, as their effects take time to materialize. The stock market's early stabilization serves as both a leading indicator and a prerequisite for broader economic improvement.

Our September 2024 assessment remains firm: China's market ended its bear phase, marking a true reversal - not just a temporary bounce. Recent developments continue to align with classic early-bull characteristics.

As John Templeton noted: "Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

Where does this leave us? Views differ, but in this phase of investor hesitation, fear is unwarranted.

Wu Weizhi

Bangkok, 5-July-2025

本期《偉志思考》簡體中文版鏈接:

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09