In October, the A-share market in China continued its downward trend in search of a bottom. The Shanghai and Shenzhen 300 Index fell by 3.17% for the entire month. Coupled with the previous declines in August and September, A-shares have experienced significant drops for three consecutive months. The sustained loss-making effect has pushed the confidence of most investors to its psychological limit. Although there was a slight rebound in the market during the last week of October, the majority of confidence remained low.

Meanwhile, the Nasdaq Composite Index fell by 2.78% in October, also marking three consecutive months of decline for August, September, and October. Fortunately, the first three trading days of November witnessed a significant rebound, sweeping away the previous gloom. However, the question of what constitutes a trend and what is noise remains an important issue that most people cannot bypass at present.

In October, what captured global attention was not the Federal Reserve or the capital markets, but the rekindling of conflict in the Middle East between Israel and Palestine.

In recent times, we believe that the most significant events related to the economy and capital markets are the "improvement of U.S.-China relations," "China issuing special national bonds in the fourth quarter," and "the potential peak of U.S. bond yields." Let's explore these topics together in this edition.

US-China relations are likely to experience a period of improvement and relaxation.

It is evident that there has been a sustained period of easing and improvement in US-China relations. Following Treasury Secretary Yellen's visit to China, Senator Schumer leading a Senate delegation, California Governor Newsom's visit to China, the US-China Economic Dialogue, the visit of veterans and their families, Foreign Minister Wang Yi's visit to the US, and the possibility of President Xi attending the APEC meeting in the US... Since the outbreak of the pandemic, it has been rare to witness such frequent diplomatic interactions between China and the US. Recently, Chinese official media outlets have also emphasized the importance of maintaining good relations between the two countries in a high-profile manner.

Based on a series of events, it appears that after years of pushing and shoving, both China and the US have gradually found answers regarding the future positioning of their relationship and how to coexist. As both sides have repeatedly stated, a complete decoupling between the two countries is unbearable for both nations and humanity as a whole.

From the actions and statements of the US, it seems that their attitude towards China is not one of complete decoupling, but rather a strategy of maintaining a "small yard, high wall" approach in the high-tech sector. This strategy is more favorable than the scenario of decoupling that many pessimists previously anticipated.

The accelerated easing of US-China relations is partly due to the rational choices made by both sides as tensions gradually subside. Additionally, as mentioned earlier, the outbreak of the Israel-Palestine conflict has served as a catalyst and impetus for this process. The ongoing conflict between Russia and Ukraine in Europe, which has lasted for over a year, has already put a strain on the US financially, leaving it in a precarious position. As a strategic ally, the US will undoubtedly provide significant military and financial support to Israel in this war. In this context, the US no longer has the capacity to address new conflicts in other regions.

In a sense, the primary contradiction for the US has undergone a significant change due to the 2023 conflict. Compared to extremist Muslim organizations that pose more lethal and immediate threats, the threat from China is still distant and manageable, as long as the Taiwan Strait issue is not deliberately escalated. Based on the historical context of the past 40 years, China can still be a partner with whom the US can maintain a good relationship. It is believed that the US understands this logic and that stabilizing the global environment requires cooperation and a good relationship with China.

Although it may be too early to envision a swift return to the relationship status of pre-2018, it is highly likely that US-China relations will experience a period of easing and improvement lasting two to three years, in contrast to the confrontations of the past two years.

It appears that our country's fortunes are indeed favorable, as the developments in this era of unprecedented global transformation gradually become more advantageous for us.

Upward adjustment in budget deficit in 4Q23 shows clear signs of stabilization

On October 24th, the Standing Committee of the National People's Congress held a meeting and approved the issuance of an additional 1 trillion yuan special government bonds, which will be used to support post-disaster recovery and reconstruction efforts at the local level and address the shortcomings in disaster prevention, reduction, and relief. The budget deficit for this year has been increased from around 3% to 3.8%. The move by the central government to increase leverage demonstrates their determination to stabilize economic growth.

This incremental issuance of bonds in the fourth quarter has indeed exceeded the expectations of many. As macroeconomic data in the third quarter showed some signs of stabilization and recovery, some analysts believed that there would be fewer stimulus measures introduced this year, given the assurance of achieving a GDP growth rate of at least 5%. However, the decision to increase leverage at this point reflects a deeper level of consideration and preparedness by the top leadership regarding the complexities and challenges of economic recovery.

We believe that this proactive preparation is highly necessary and forward-thinking.

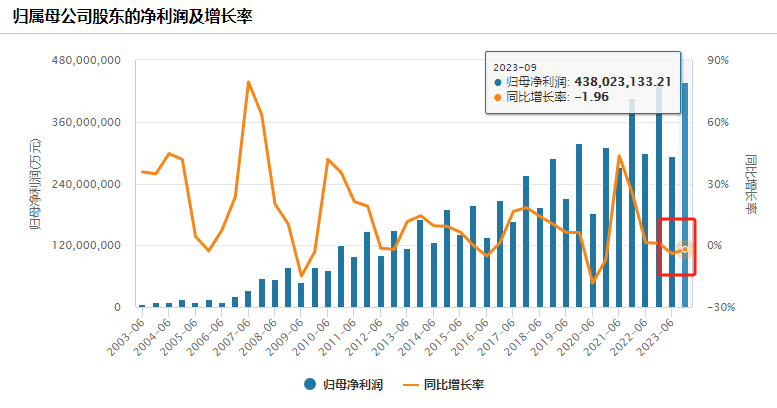

The chart above represents the data disclosed in the third-quarter reports of all A-share listed companies. From the third-quarter reports, it can be observed that profitability has shown signs of stabilization and recovery compared to the semi-annual reports. However, when we look at the micro perspective, the real estate sales data in October continued to decline after a brief rebound. The number of listings for second-hand houses has continued to increase, reaching new highs, and the downward trend in real estate prices is expected to have taken shape. The profitability and cash flow situation of most real estate companies are still deteriorating. Following the stock and bond price declines of Jinke and the recent significant drop in Vanke's US dollar bonds, it is evident that investor expectations have not improved and have even worsened at the margin. Therefore, the top leadership has sufficient grounds not to be excessively optimistic based on short-term data moderation, and it is necessary to have policy reserves in place to support the economy.

The introduction of a series of policy measures following the Politburo meeting on July 24th has had a significantly positive impact on stabilizing the overall economy in the third quarter. However, the deep impact of the three-year-long pandemic on household wealth and the negative repercussions of the real estate industry downturn on related supply chains and local government fiscal revenues are gradually unfolding and continue to pose challenges to the economy. While we should not underestimate the damaging effects of these negative factors, it is clear that the government maintains a stance of further policy reinforcement if necessary. Achieving a complete turnaround in the real estate industry may still require additional time and stronger policy implementation

US Treasuries yield peaking out

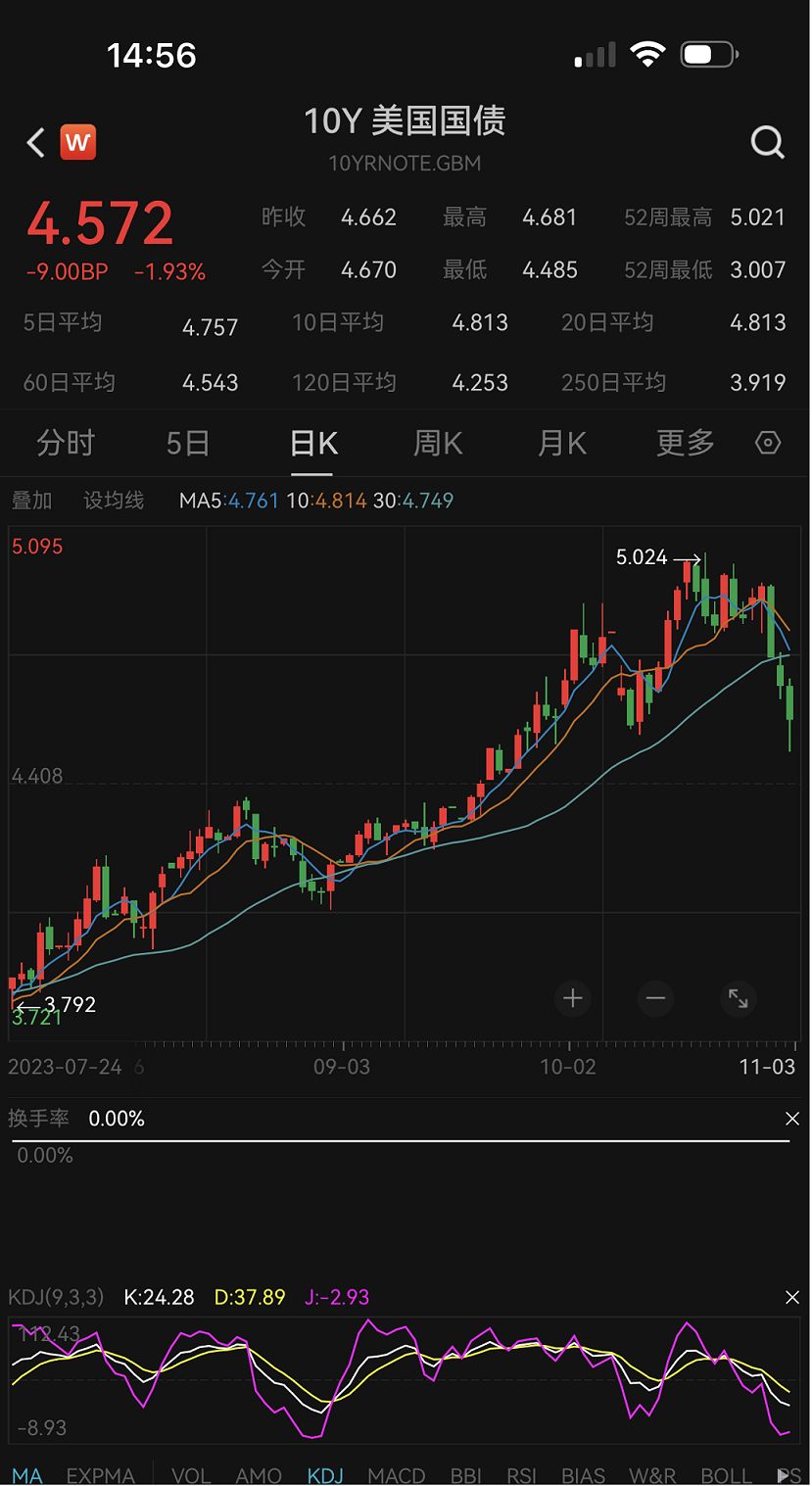

Recently, with the release of a series of economic data in the United States, although the economy continues to show strong growth, there has been a noticeable cooling in non-farm payroll data. Hedge fund manager Bill Ackman also tweeted that he had closed his short positions on US Treasuries, suggesting that there are risks to continuing to bet against US bonds at this stage. Subsequently, the Federal Reserve's monetary policy meeting in November maintained the status quo and paused interest rate hikes.

Investment professionals widely believe that in the absence of major unexpected events, the current level of interest rates has been sustained for a sufficient period of time to allow the US economy and inflation to cool down. The transmission effects of interest rate hikes take time, and the necessity of further rate hikes is considered low. If US-China relations can be appropriately eased and trade between the two countries improves, it would also contribute to alleviating inflationary pressures in the United States.

Recently, US bond yields have started to decline from their highs, which may reflect market expectations in this regard. US Treasury rates serve as an anchor for global asset pricing. While it is difficult to predict whether we will quickly enter a downward interest rate cycle in the future, a halt in the upward trend is important for the stability of financial markets and the global real estate market.

Recent Strategy

The downward trend in October has left many investors feeling desperate. The characteristics of the market bottom phase are still evident. In recent conversations with fund managers and investors, there is a general sense that, based on past experiences, it is time to actively increase positions. However, there are two dilemmas. Firstly, it is uncertain what to buy. Qualitatively good companies that investors are familiar with seem to be experiencing continuous outflows of foreign capital, and their valuations appear awkward. On the other hand, hot sectors and trends lack fundamental confidence, making it difficult to make a move. Secondly, it is challenging to identify the factors that will drive the stock market's rise or which sectors will lead the rally. The desire to buy exists, but the contradictions and hesitations arise when it comes to executing the trades.

In fact, this phenomenon is similar at the bottom of every bear market. I have personally experienced the same dilemma. Of course, different people have different solutions, depending on their investment systems. What works for one person may not work for another. We won't delve into that discussion here.

Recently, I came across a report by Zhang Yidong from Xingye Securities titled "Don't Worry About the Long Journey, the Wind Will Come." I think the title is particularly appropriate. Most people like to pursue precision, but the most dangerous and taboo thing in securities investment is the pursuit of precision! There is an old saying that "being vaguely correct is better than being precisely wrong by a hundredfold." During a bubble, who can accurately predict the exact day or the final straw that bursts the bubble? In fact, those who can accurately predict are just lucky: what's important is to stay away from the bubble, rather than accurately predicting the timing of its burst. The same applies to the bottom range – after eating three buns and still not feeling full, can you accurately predict the second or the exact bun that will satisfy your hunger? What matters is to persistently do the right things in the undervalued range in the long term.

Specific strategies include maintaining a moderately high position, continuously optimizing the portfolio, and selecting high-quality growth stocks and high-dividend stocks. As for cyclical growth stocks, the time to exit may not be far off.

Best Regards,

Wu Weizhi

Nov 2023

本期《偉志思考》簡體中文版鏈接:

伟志思考:中美关系和各种因素正在发生积极的变化

WE Think: How should we view the sharp rises and falls in gold and silver prices? Is the new Fed chair hawkish or dovish?

At the start of 2026, global politics, economics, geopolitics, commodities, and capital markets have experienced dramatic fluctuations, with many even

2026-02-02WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09