WE THINK: Investors’ Confidence and Patience are Equally Important. What’s the Future for Small Cap Stocks?

After the market closes this Friday, the second quarter of 2024 will soon become history. In the first half of the year, the Wind All-A Index decreased by 8.01%. Notably, the blue-chip CSI 300 Index performed significantly better than the overall market, increasing by 0.89% The Shenzhen Stock Exchange Component Index, GEM Index, and Science and Technology Innovation 50 Index increased by -7.1%, -10.99%, and -16.42% respectively.. During this period, the capital market has been very mixed and polarized. Although there is a partial profit-making effect, the stock prices of most companies have fallen, resulting in great losses for many investors. Among the 5,379 listed companies in the market (including 16 companies that delisted this year), only 800 companies (including companies that went public this year) rose in the first half of the year, only accounting for 14.87%. The market-wide median stock's gain was negative, at -23.53%. Although it was still relatively difficult to make money in the market in the first half of the year, Among this struggling market, however, Rabbit Fund managed to take advantage of both the depth and breadth of research and encouraged collaborative teamwork in order to avoid the risks of the downward industry and grasp bottom-up opportunities. Due to these decisions, its product performance significantly outperformed the CSI 300 Index benchmark.

In the first half of the year, small-capitalization companies fell sharply as a whole. Why did small-capitalization companies plummet this year? Do small-capitalization companies have a future? Many investors are currently trapped in growth stocks that are recognized as high-quality consumer or new energy tracks. Is growth investment still worth waiting for? In this issue of Wei Zhi Thinking, we will discuss these issues.

Why did small-capitalization companies plummet? Will small-capitalization companies still have opportunities in the future?

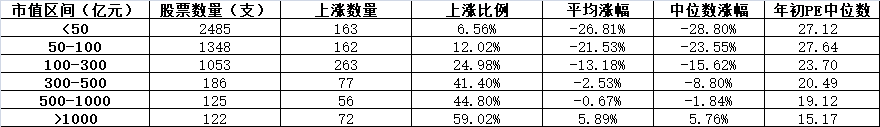

Small market capitalization companies have been hit the hardest this year. In the table below we can clearly see that in the past six months, the smaller the market capitalization of the company, the higher the probability of devaluation. This style differentiation is mainly based around market capitalization. The number of devaluation factors used to be relatively low. Why has there been a sudden uprise of components this year? Recently, there have been rumors that many public funds have begun to raise the threshold and necessary qualifications for stock entry into the pool, where companies with a market value of less than 5 billion cannot enter the pool. Although this rumor cannot be verified or falsified, it does reflect certain current trends of thought.

We believe that this result is the resonance of internal and external factors. The internal factoris that the overall valuation of companies with small market capitalization is still relatively expensive. And the external factor is that with the strict implementation of the new delisting policy, the impact caused on small market capitalization companies in the short and medium term cannot be underestimated.

It is not difficult to see from the data in the table above that companies with a market capitalization of more than 50 billion have a median valuation of 15 times. As the market capitalization decreases, the overall valuation level of companies with small market capitalization is significantly higher than that of large market capitalization. Among the 3,833 companies with a market capitalization of less than 10 billion, the median valuation is 27 times, which is significantly more expensive than companies with large market capitalization. This is related to the past long-term speculations that domestic investors prefer small-market companies, which has led to the unreasonable phenomenon of high valuations of small companies with poor performance stability in the chinese market. This is very different from the liquidity valuation premium that large-capitalization companies in mature capital markets will enjoy. Perhaps the squeeze of the small-capitalization bubble this time is the price that must be paid for China's capital market to mature.

From the perspective of the economic situation, during the painful period of transition between old and new growth drivers, many companies in the industry which chain with old growth drivers are facing declining demand, while many small and medium-sized companies with market capitalization are companies in the middle reaches of the industry chain. In an environment where total demand is weak, competition intensifies and price involution increases operating pressure. If the decline in performance is greater than the decline in stock price, there will be a phenomenon that the lower the decline, the more expensive the valuation will be. Most of the companies with large market capitalization are industry leaders or public utility companies, and their performance stability during economic downturns is significantly better than that of small and medium-sized companies. , On one hand, regulators have advocated that listed companies strengthen shareholder returns and increase dividends since the beginning of this year. It is logical that companies with stable performance, good cash flow, and the ability and willingness to pay dividends have become more popular and sought after by investors. Both the absolute and relative valuations of this type of company are still very attractive, and their overall performance in the first half of the year was considerably better.

On the other hand, with the implementation and strengthening of the new delisting system, the effect of the plummeting share prices and near-zero wealth of delisted companies, especially the risk of delisting when the share price falls below 1 yuan, has caused a large number of low-priced stock holders to worry about the risk of their stocks being delisted after a drop, leading to a stampede-like decline in low-priced stocks. In addition to the "delisting panic", the number of listed companies under investigation and company chairmen detained this year has also increased significantly compared to previous years. Whenever a company encounters such treatment, it is generally difficult for its share price to escape a plunge.

This "magnetic attraction" of the 1 yuan threshold and the increase in the number of regulatory investigations have led investors to be afraid to continue holding low-priced stocks. Compared to the delisting standards of major global exchanges, we can say that ours is the strictest. From a long-term perspective, increasing the intensity of delisting may have a positive guiding role in advocating long-term investment, fundamental investment, value investment, and the cultivation of patient capital. However, from a medium and short-term perspective, the continuous decline of a large number of small and medium-sized and low-priced stocks has caused significant damage to investors' wealth and investment confidence, increasing the difficulty of stabilizing the capital market, which should not be underestimated.

Recently, some large companies with hundreds of billions in market value, such as HNA Holdings, which have the ability to continue operations, are also facing the risk of being delisted due to their share price falling below 1 yuan. Many leading companies in cyclical industries also face the risk of cyclical losses in the downturn years, and if they are forced to delist just because their share price temporarily falls below 1 yuan, it is worth serious discussion whether this is protection or harm to investors. In 2016, after the decision-makers discovered the negative consequences of the "circuit breaker policy", they promptly suspended the policy, and the market quickly stabilized. Problem companies and bad apples should indeed be resolutely eliminated, but for excellent companies in cyclical industries and with sustainable operations, how can we avoid inadvertent damage? Is it also possible to discuss improving the 1 yuan delisting standard?

On the issue of whether small-cap companies still have a chance in the future, our view is very clear. Almost without exception, any great enterprise (especially private enterprises) has grown from a small company. As a growth-oriented fund manager, to despise small-cap companies is utterly absurd. Although the small-cap sector is currently in the depths of winter, just like the previously overvalued growth stocks, the short-term loss effect is obvious. Even though the current decline has not yet shown signs of ending, after this cold winter ends, the best growth stocks among these small and medium-cap companies will have returns far higher than the high-dividend assets that are currently in vogue!

While there will be great opportunities in small companies in the future, for most investors, the difficulty of grasping these opportunities is very high. To dig out 3-5% of excellent companies from the approximately three thousand companies requires investors to have very strong research capabilities, as well as breadth and depth of research. Due to the low proportion of quality companies, if one wants to capture this opportunity by buying a small-cap stock ETF, it may not necessarily be effective.

I recently read an article about growth fund managers being cornered, which resonated with me deeply! Indeed, since 2021, industries such as consumer and new energy, which were the star growth stocks in the previous round, have begun to enter a phase of synchronized decline in both stock prices and business performance. By now, growth stock investment has gradually become an area that everyone is desperately trying to avoid. Does this mean that the growth investment style is entering its darkest moment? Is this a good thing or a bad thing?

As a veteran who has been battling in the Chinese stock market for 31 years, this kind of situation is not unfamiliar to me at all. The cyclical rotation of investment styles is an integral part of market rules. If you adapt well, it's like an ATM, but if you get it wrong, you'll be the one getting withdrawed from. Although it may still be a bit early to massively buy growth stocks and sell value stocks right now, no trend can go on forever without end, and this one will be no exception. Having confidence in the principles that need to be upheld is very important, and so is patience.

In the context of China's economy entering a new era of high-quality development and the great transition of old and new driving forces, we need to have confidence and patience in the economy. We also need greater patience with the capital market.

Investment Takeaways

During these times of recession, it is extremely important to keep your confidence and be patient!

Maintain a structural market mindset, and maintain a volatile market mindset. Leverage the advantage of having both breadth and depth of research, continuously optimize the investment portfolio, and patiently sow the seeds for spring.

Wu Weizhi

2024 June 30

WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09WE Think — The Hardest Part of Investing: What to Do After Missing the Rally

In the current market environment, consensus on a bull market is gradually strengthening. The A-share market showed significant acceleration in August

2025-09-01