In October, the A-share market exhibited a pattern of high openings followed by declines and wide fluctuations. The Wind All A Index rose by 2.28% for the month, but the pullback from its high reached 16.8%. The CSI 300 Index saw a monthly change of -3.16%, with a volatility of 17.05%.

After the National Day holiday, the rapid rise before the break and the strong performance of the Hong Kong stock market during the holiday inspired optimism. Various self-media outlets continuously propagated this positive sentiment, leading many new investors to hurriedly open accounts, transfer funds, and enter the market. On the first trading day back, trading volume hit a historical high of 3.48 trillion yuan. Since September 24, the market has accumulated considerable gains and profit-taking positions, resulting in significant turnover between new investors and seasoned shareholders. New investors who chased prices at the beginning of October are now getting their first taste of the turbulent waters of the stock market.

Recently, there have been quite a few stocks in the market experiencing significant price increases due to restructuring or thematic speculation. In contrast, some fundamentally strong blue-chip stocks have shown much lower price elasticity this month compared to poorly performing or restructuring stocks, with some even experiencing declines.

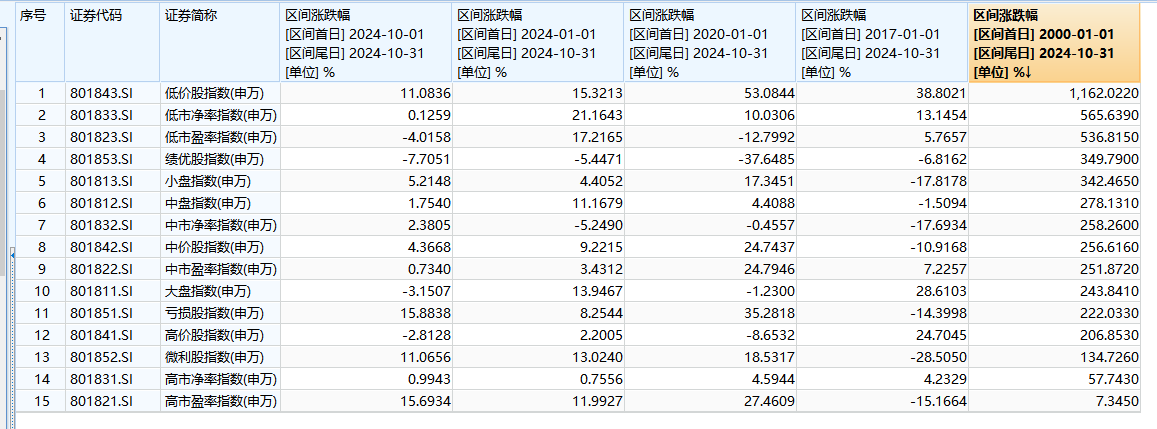

A few days ago, I saw someone post the following statement in a social media group: “We’ve returned to an era where discussing fundamentals means starting from behind the starting line!” They also included the following chart.

How should we view the recent performance of poorly performing stocks far exceeding that of blue-chip stocks? Is fundamental investing really ineffective? Why is it also difficult to make money in a bull market? In this issue of WE THINK, we will explore these two questions.

Are blue-chip stocks really unable to outperform poorly performing stocks? Is this truly the case?

Investors often tend to overemphasize current and recent events while neglecting long-term and essential factors. They can easily be distracted by the noise in the market, failing to seriously consider the most important fundamental and long-term elements. Drawing conclusions based on a month's performance is clearly hasty and superficial!

I remember when I was very young, I heard a teacher say, "An eagle may sometimes fly lower than a sparrow, but a sparrow will never reach the height of an eagle." The same applies to the stock market. Friends familiar with the investment research system ofRabbit Fund know that we categorize stocks as: trees, grains, and grasses. In some phases, grass may grow faster than trees, but grass can never reach the height of a large tree! Looking at the following chart from a longer-term perspective, you may find it impossible to conclude that discussing fundamentals means starting from behind the starting line.

When comparing the two charts, the conclusion naturally aligns with the investment master Warren Buffett's famous saying: "In the short term, the stock market is a voting machine; in the long term, it is a weighing machine."

The recent popularity of small-cap and restructuring-themed stocks is also easy to understand. Recently, in addition to the central bank increasing liquidity, the China Securities Regulatory Commission has supported and encouraged mergers and acquisitions among listed companies to invigorate the capital market. This has provided a new avenue for "distressed" companies facing difficulties in their main businesses, which have no other options but restructuring and mergers. It has temporarily shifted the previous strong regulatory stance, increasing the pressure for delistings and maintaining a regulatory tone of ensuring that companies that should exit the market do so.

Distressed companies often have very small market capitalizations, and in an environment that encourages restructuring and has good market beta, it is common to see fivefold or tenfold stock increases. This has a very positive effect on revitalizing the market and reversing the past bear market mentality of making small profits and exiting. As we mentioned in our online discussion on October 9, a true bull market must be characterized by a flourishing diversity, where all types of investors can make money, not just those adhering to a single investment style. This is what constitutes a healthy bull market.

As for whether to invest in blue-chip stocks or participate in the speculation of restructuring stocks, I think everyone's situation is different, and we cannot give random advice. I just want to remind you that blue-chip stocks are more suitable for patient capital. When it comes to thematic speculation, it is crucial to remember that this is a game; timely exit is very important. Those who exit late must pay the price for all participants. (Think back to the period from 2013 to 2015 with stocks like LeTV, Baokangli, Longma Information, and Quanta Education—where are they now? For those who got involved and did not exit in time, how are they faring today?)

Regarding M&A and thematic stocks, this is indeed outside our circle of competence. Our stance is not to earn money from them, and we will never lose money on them; we remain indifferent and send our distant blessings. From 2013 to 2015, we did not buy a single share of the aforementioned big winners. Although there were many growth stock stars during that time that made others envious, it did not prevent us from achieving very substantial returns over those three years. In a bull market, being able to consistently earn money within your circle of competence is already quite wonderful!

Why is it difficult to make money even in a bull market?

There are many pitfalls that can lead to not making money even in a bull market, and I have personally encountered countless of them. Today, as we explore this topic for the first time, let's discuss the two biggest pitfalls.

The first major pitfall of not making money in a bull market — failing to timely form a judgment and belief about whether the market has entered a bull market, and not being able to shift from a bear market mindset to a bull market mindset.

Most investors often wait until the middle or later stages of a bull market, when the market and stock prices have already risen significantly, valuation levels are very high, and investor wealth effects and enthusiasm for entering the market are at their peak. Only then do they begin to believe that the market has genuinely entered a bull market.

Indeed, for most people, in the early stages of a bull market, when the economy has not fully emerged from a downturn and the market experiences fluctuations with only modest profit effects, it is not in line with the common sense of the majority to firmly believe that this is the arrival of a bull market. However, it aligns with the common sense of the "minority."

Without a strong judgment and confidence in certain matters, there will always be downward disturbances and negative noise during the process. Selling at a loss when the market drops is a crucial survival experience from a bear market, but it is also the hallmark of bear market thinking. In contrast, in a bull market, if a stock you favor declines, instead of stopping out, you should dare to increase your position.

(This discussion purely focuses on market beta. The stocks each person holds can vary greatly, and not all stocks are suitable for adding to when they drop. Just because a bull market is underway does not mean all industries and companies will see their stock prices rise; there is a wealth of specialized knowledge to learn and cultivate for long-term, stable investing!)

In a bull market, especially in the early and middle stages, there is generally no fear of being "caught" in a downturn because the market will reach new highs after the adjustments end. This is akin to how, in a bear market, a rebound will eventually lead to new lows. While the market may not rise every day, the overall valuation level tends to rise amid rotation and fluctuations. Patience in holding good companies is the most important investment strategy in a bull market. Many investors tend to believe that when the market rises, it signifies a strong bull market, and when it falls, they assume the bull market is over. This mindset is likely shared by many investors. The difficulty lies in the inability of most to distinguish between trends and noise. That is the core issue!

The second major pitfall of not making money in a bull market — although there is a belief in the bull market, the expectations and goals set for oneself are too high, and there is a lack of true understanding of investment principles.

After waiting for years, a bull market finally arrives, but earning only 30-50% each year is hardly satisfying for that eager bull heart. Investors actively seek out the brightest stars in the bull market, embracing the most elastic industries and companies. With the main board's daily limit set at 10%, it pales in comparison to the 30% gains seen on the Beijing Stock Exchange, leading to a constant search for the next hot spot or trend.

Indeed, there are some seasoned short-term traders with a talent for trading who can quickly amass wealth in such an environment; I have real-life examples of this among my acquaintances. But to be honest, I have tried hard, and trading doesn’t seem to be my strong suit. Among my friends, those who excel in this area are truly one out of a million.

Investing is akin to farming. Imagine you are growing rice in your own field, but after seeing your neighbor's corn reaching harvest, you hesitate and decide to pull out your rice to replant corn. After a while, you notice that the corn isn’t yielding any harvest, while your friend’s orchard is starting to bear fruit, and this year's fruit prices are very tempting. So you go home and pull out the corn to plant fruit trees instead. After several months of this back-and-forth, autumn arrives, and you find that while others have different harvests, you have gone through multiple cycles without any results and have even lost money on fertilizers and seeds.

You only see the beauty of the harvest at others' fields, but fail to recognize the patience, care, and dedication that went into their spring planting and summer tending. Therefore, whether in securities investment or farming, only by understanding and respecting the rules can patient capital achieve good returns. (Patience is a necessary but not sufficient condition; when combined with understanding and following the rules, it becomes a nearly sufficient condition.)

Recent Strategy

The overall development of the market is still in line with our expectations. After the highs and subsequent pullbacks in October, investors have returned to a state of hesitation and divergence. This psychological state is characteristic of the early stages of the market, and we believe that, as the market develops and economic data improves, a consensus will be reformed.

Markets are born in despair, develop in hesitation, mature in optimism, and end in madness. At a time when hesitation is prevalent, we should be even more resolute!

In terms of specific investment strategy, we will maintain an actively offensive position, gradually increasing the slightly reduced positions from earlier in the month back into companies we have long-term confidence in. We aim to be patient capital, accompanying quality enterprises as they grow.

WU Weizhi

Nov 3rd 2024

本期《偉志思考》簡體中文版鏈接:

WE Think: 2026 Outlook—Gratitude for the Era, Embracing the Bull Market

In 2025, global capital markets far exceeded expectations. China’s major indices—Wind All A, Hang Seng, CSI 300, and ChiNext—rose by 27.65%, 27.77%, 1

2026-01-04WE Think: Will Actively Managed Equity Funds Embrace a Spring in 2026?

China’s equity market saw moderate corrections in November. The CSI 300 Index declined 2.46%, the Wind All A-Share Index dropped 2.22%, while small-ca

2025-12-01WE Think — The Busan Summit Marks a Historic Turning Point, the Dawn of the G2 Era

China's capital markets saw notable volatility in October, driven by renewed U.S. tariffs and rare-earth export controls. The CSI 300 and the Wind All

2025-11-03WE Think —Why was this holiday truly a 'Golden' week, as gold prices hit record levels?

China’s capital markets maintained their bullish momentum in September, with both A-shares and Hong Kong stocks performing strongly. The Hong Kong mar

2025-10-09WE Think — The Hardest Part of Investing: What to Do After Missing the Rally

In the current market environment, consensus on a bull market is gradually strengthening. The A-share market showed significant acceleration in August

2025-09-01